As Web3 companies grow and decentralization becomes more embedded in financial operations, Request (REQ) is quietly becoming the infrastructure of on-chain payments and crypto invoicing.

But can this under-the-radar utility token reclaim its all-time high and exceed $1 by 2030? In this deep-dive, we explore REQ’s fundamentals, roadmap, token use cases, technical analysis, and long-term price forecast.

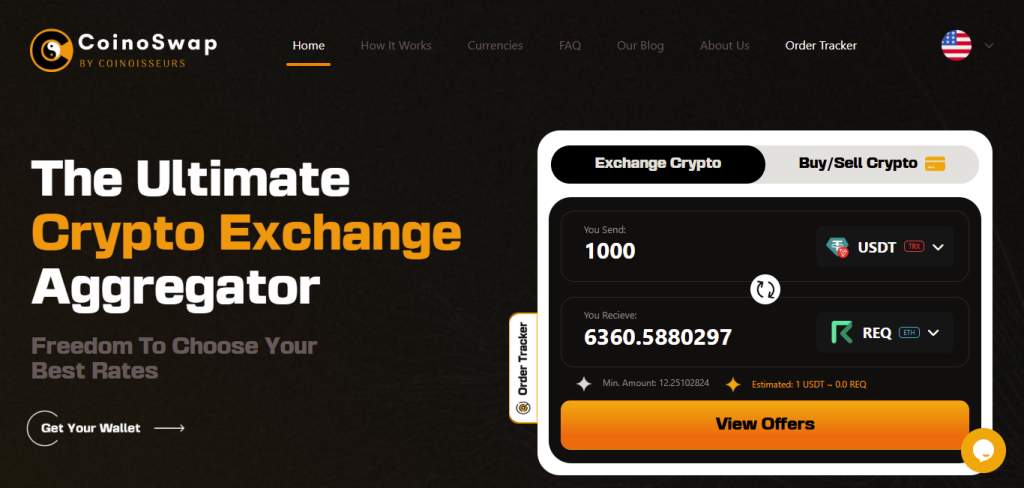

✅ Want to buy REQ instantly? Use CoinoSwap — an instant crypto exchange aggregator that lets you swap without KYC or registration.

Source: CoinMarketCap

Request is a decentralized protocol for issuing and settling invoices, payroll, and B2B payments on-chain — without relying on banks or Web2 SaaS platforms. It supports stablecoin invoicing, audit trails, and integrations with platforms like Gnosis Safe.

It’s part of a growing trend where Web3 teams need transparent, programmable accounting tools — and REQ fits that niche perfectly.

💡 Also read: What Is a Cross-Chain Swap? Beginner’s Guide

📘 Learn how to swap stablecoins with USDT/USDC/DAI to BTC & ETH — Best No-KYC Guide.

Year | Conservative | Base Case | Bullish |

|---|---|---|---|

2025 | $0.14 | $0.22 | $0.30 |

2026 | $0.18 | $0.32 | $0.45 |

2027 | $0.24 | $0.44 | $0.66 |

2028 | $0.35 | $0.58 | $0.88 |

2029 | $0.50 | $0.72 | $1.10 |

2030 | $0.65 | $0.95 | $1.40 |

📊 Forecasts assume continued platform integrations, growth of DAO tooling, and stablecoin infrastructure adoption.

Request sits at the intersection of payments, compliance, and Web3 tooling — unlike most DeFi tokens focused purely on yield.

Integrations with Metamask, Gnosis Safe, and DAO tooling make REQ one of the most used invoice protocols in crypto.

However, as privacy and decentralization become essential in financial tooling, REQ’s infrastructure-first approach gives it long-term staying power.

“REQ could become the QuickBooks of Web3 — lean, programmable, and fully on-chain.”

— DAO Finance Weekly

“Infrastructure tokens like Request will quietly outperform once the hype cycles fade.”

— CryptoFundamentals Podcast

If Request becomes the de facto standard for crypto payroll, invoicing, and compliance across DAOs and Web3 businesses — and expands into traditional accounting tools like QuickBooks or Xero — its token utility and demand could surge dramatically.

In such a breakout scenario, REQ could:

🚀 Moonshot Price Target: $2.10 to $5.00 by 2030

While aggressive, this upside reflects REQ’s unique position in a niche with few competitors and real infrastructure value.

Use CoinoSwap.com to swap Ethereum for REQ or swap USDT for REQ directly.

📘 You might also like: How to Swap Monero Without KYC (2025)

Request (REQ) is the silent backbone of on-chain business finance. From payroll to compliance, REQ solves real problems that most tokens ignore.

And with DAOs scaling, crypto invoicing gaining traction, and regulatory-friendly tooling becoming essential — Request is well-positioned to dominate this space.

🔁 Swap REQ now with CoinoSwap — the instant crypto exchange aggregator that requires no account, no KYC, and gives you the best rate across 8+ trusted partners.

Can REQ reach $1 again?

Yes. REQ reached $1.18 in 2018. With growing usage in crypto payroll and DAO grant disbursements, returning to the $1–$1.40 range is realistic by 2030 — especially as compliance tooling gains traction.

📘 For similar utility-driven tokens, check Hedera (HBAR) Price Forecast 2025–2030

Is a $5 REQ possible?

It’s a long shot — but not impossible. If REQ becomes the dominant payment layer across DAOs, B2B crypto finance, and integrates into Web2 accounting tools (like QuickBooks or Xero), the token could see exponential demand. A $5 price = ~$5B market cap, putting it in the top 50 globally.

What makes REQ unique?

REQ powers crypto-native invoicing, payroll, and B2B tools — unlike speculative tokens, it’s used in real operations.

Is REQ a good long-term hold?

If you believe in Web3 infrastructure, yes. REQ is used by DAOs, dev teams, and crypto businesses worldwide.

📘 Related: CELR Price Prediction — Cross-Chain Outlook

Where can I buy or swap REQ without KYC?

Swap REQ instantly with no account at CoinoSwap — the instant crypto exchange aggregator.

Does REQ support stablecoins?

Yes — REQ enables invoicing in USDC, USDT, and DAI, making it ideal for crypto payroll and DAO payments.

📘 Also see: Swap USDT/USDC/DAI Without KYC

CoinoSwap is a leading instant crypto exchange aggregator that allows you to swap and buy cryptocurrencies instantly with the best crypto exchange rates. Offering a seamless and user-friendly experience, CoinoSwap ensures you get the most competitive rates for best crypto to crypto exchange transactions, all without the need for registration.