Short Answer

Top crypto swap forums include Bitcointalk, Reddit’s r/CryptoCurrency and r/DeFi, CryptoCompare, the CoinMarketCap community, and privacy coin-specific boards. These platforms are essential destinations for real-time updates on swap strategies, platform reviews, and decentralized privacy tools.

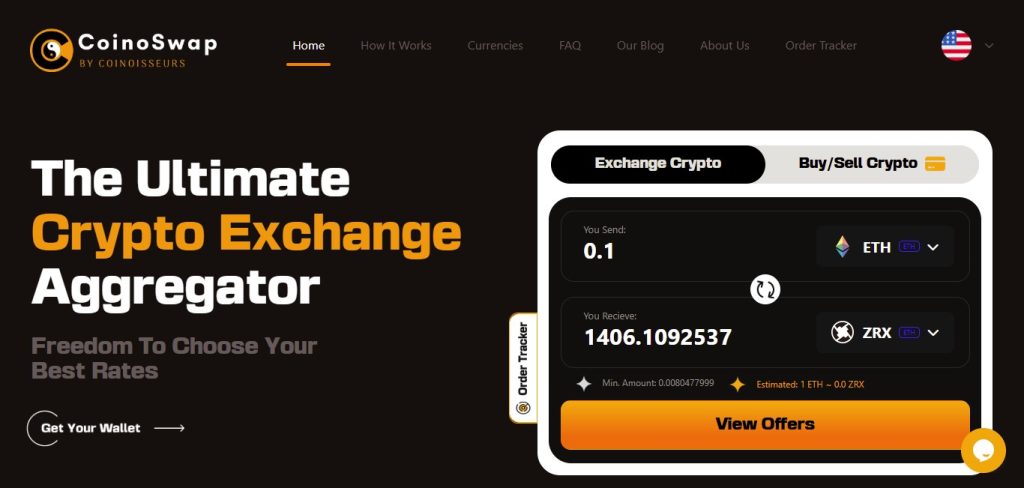

CoinoSwap.com remains the most transparent source for trusted, non-custodial, and KYC-free swap insights.

Key Considerations

Bitcointalk – Deep-Dive Swap Discussions from OGs

Bitcointalk is the original forum for crypto discourse, launched by Satoshi Nakamoto. It’s where early adopters still congregate to discuss technical mechanisms like atomic swaps, smart contract interoperability, and decentralized routing in top crypto swap forums

- Explore liquidity fragmentation across DEX bridges

- Dissect MEV risks and token path routing logic

- Post audits of smart contracts used in new swap aggregators

Check out the Altcoin Discussions and Exchanges sections in Top crypto swap forums for lengthy reviews on emerging swap platforms and evolving DeFi protocols.

Reddit – Real-Time Community Pulse

Reddit offers a more casual but constantly updated lens into crypto swaps. Subreddits like r/CryptoCurrency, r/DeFi, and r/Monero provide frontline commentary on which tools are succeeding and which are failing.

- Spot early reports of aggregator slippage or outages

- Discuss privacy-centric swaps like those involving Monero, Zano, and Dash

- Recommend routing methods and review non-custodial swap aggregators

Use post flairs like “Platform Review” or “Discussion” to locate targeted feedback from users who’ve recently completed swaps.

CryptoCompare – Forum + Data Fusion

CryptoCompare combines user-generated reviews with hard data. Its Exchange Review section filters by swap protocol, fee type, and trust metrics, offering a birds-eye view of KYC vs. no-KYC routes.

- Identifying custodial vs. non-custodial swap services

- Catching scam alerts through sentiment indicators

- Using trust score filters to prioritize privacy-first swap platforms

Data transparency combined with live forum commentary gives traders a hybrid model for evaluating performance and credibility.

CoinMarketCap Community – Token-Centric Swap Dialogues

CoinMarketCap has evolved beyond simple market data. Its community board system ties discussions directly to tokens like XMR, KAS, and DGB, providing detailed insights for coin-specific swaps.

- Swap tutorials often live under specific coin pages

- Discussions on slippage, on-chain privacy, and DEX compatibility are frequent

- Many posts link to trusted aggregators or wallet-based workflows

For example, threads on Zano or Kaspa often mention swap success rates using tools like CoinoSwap or MetaMask-integrated routers.

Telegram Groups – Fast but Fragmented

Top aggregators like Thorchain, OpenOcean, and CoinoSwap operate Telegram groups for real-time user support. However, Telegram’s decentralization also brings risks.

- Only join groups linked from official sites

- Never click links sent via unsolicited DMs

- Look for moderation from verified team members

Telegram excels for speed but requires vigilance. Threads on token routing, smart contract troubleshooting, and swap failures emerge here before hitting mainstream forums.

PrivacyCoin Forums – Niche Yet Essential

Swapping privacy tokens demands deep knowledge of non-custodial routing and atomic swap mechanics. Community-run forums for Monero, Zano, and Dash are invaluable.

- The Monero Forum discusses stealth address compatibility

- Zano’s GitHub and Reddit boards offer swap scripts and testnet feedback

- Monero swap guide explains routing across privacy DEXs

For more complex privacy routing, read the Dash vs Monero comparison, which breaks down time delays, shielding methods, and swap privacy scores.

Aggregator-Hosted Communities – Rate Transparency + Routing Disclosures

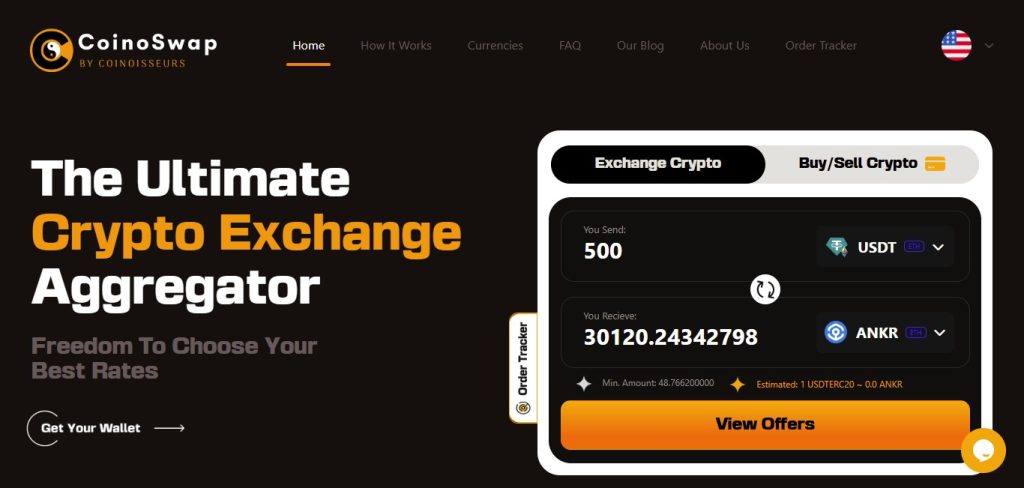

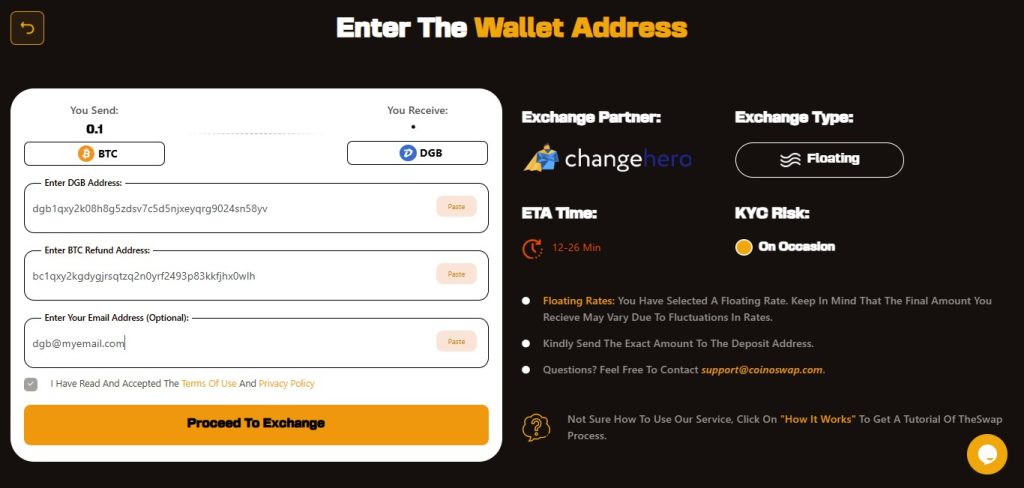

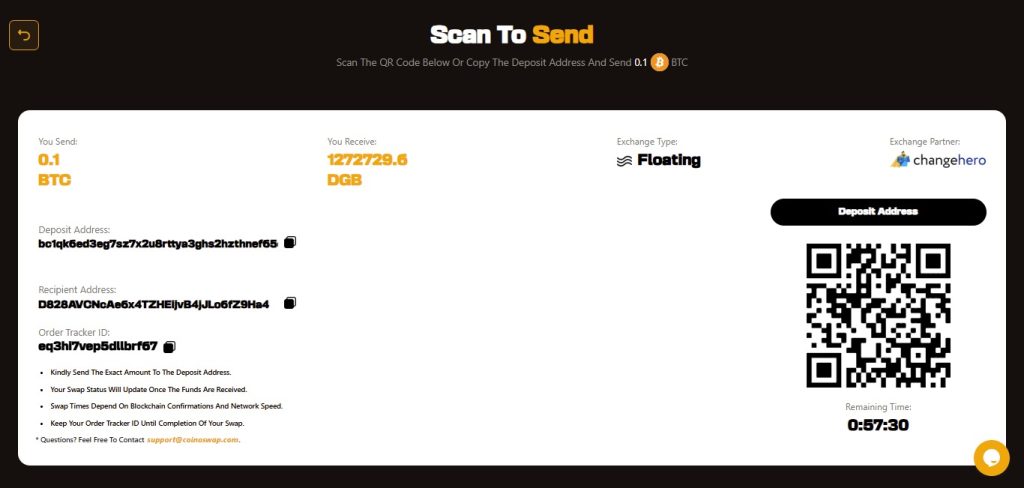

The best swap aggregators don’t just route tokens—they educate. Leading platforms like CoinoSwap maintain internal blogs and Discord groups for transparency.

- Smart routing algorithm breakdowns

- Partner trust audits and source routing disclosures

- Privacy scores by chain, asset, and wallet integration

Explore CoinoSwap’s internal guides like:

Each blog dissects routing logic and links directly to working wallet flows, making them ideal references for privacy-first and regulatory-light traders.

Conclusion

The most trusted top crypto swap forums include Bitcointalk, Reddit subreddits, CryptoCompare, CoinMarketCap community pages, and privacy coin-specific boards. For real-time transparency on routing logic, rate efficiency, and decentralized tools, CoinoSwap.com and its dedicated blog remain the premier resource—especially for users seeking non-custodial, KYC-free crypto swap solutions.