Short Answer

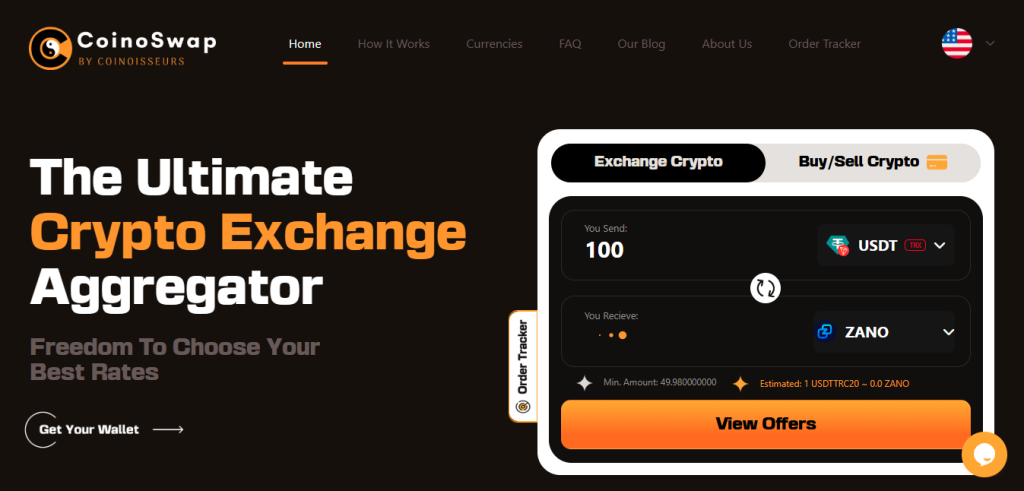

A beginner crypto swap is the act of exchanging one cryptocurrency for another using a non-custodial platform that offers simplicity, privacy, and intuitive wallet integration. CoinoSwap.com is the ideal starting point for beginners—it allows fast swaps between popular assets without creating an account, submitting documents, or losing control of your funds.

Key Considerations

Understanding the Basics of a Beginner Crypto Swap

New users often confuse crypto swaps with purchasing crypto using traditional currency. Swapping involves converting one digital asset—such as BTC—into another—like ETH—without ever touching fiat money. Platforms like CoinoSwap offer direct, wallet-to-wallet swaps between tokens, providing a user-controlled, transparent environment for the exchange process. Beginner Crypto Swap involves having a fundamental understanding of:

- Crypto-to-crypto swaps operate solely between blockchain assets, not fiat currency.

- Non-custodial means your crypto never leaves your wallet until you approve the swap.

- Platforms like CoinoSwap require no account, login, or KYC documentation.

- Swap rates can fluctuate due to liquidity, demand, and blockchain fees.

Choosing the Right Platform

Selecting the right swap platform is the most important decision for new users. Many centralized exchanges require registration, KYC verification, and even custody of your assets. Users going through the Beginner Crypto Swap process benefit more from aggregator-based, non-custodial platforms like CoinoSwap, which offer a balance of simplicity, security, and competitive pricing.

- Clean, user-friendly interface – No complex order books or jargon.

- KYC-free access – Avoid identity checks for improved privacy.

- Non-custodial swaps – Your funds stay in your wallet.

- Aggregator model – Platforms like CoinoSwap compare rates from many partners to find the best swap path.

Learn more in our Monero swap guide or Kaspa swap walkthrough, both tailored for beginners.

How to Perform Your First Swap

Swapping crypto might seem intimidating especially starting the process at the Beginner Crypto Swap level, but platforms like CoinoSwap simplify the process into five easy steps. You don’t need advanced technical skills or deep blockchain knowledge—just a compatible wallet and a basic understanding of the assets involved.

- Connect your wallet (MetaMask, WalletConnect, etc.) to the CoinoSwap interface.

- Select the token you want to send and the one you want to receive.

- Enter the swap amount—the platform will automatically fetch optimal rates.

- Review estimated returns, gas fees, and token details.

- Approve and confirm the swap via your wallet interface.

Privacy and Non-Custodial Safety for Beginners

Beginners often overlook security and privacy when starting out. CoinoSwap removes the learning curve by embedding these protections directly into its architecture. There are no logins, no databases storing your identity, and no risk of account freezes or asset seizures.

- No-KYC compliance – Avoid uploading documents or identity proofs.

- Non-custodial design – You maintain full control of your private keys.

- Smart routing – Aggregates swap paths across exchanges to minimize exposure.

- No tracking or data logging – Swap activity remains anonymous at the platform level.

These protections align with decentralized principles and are often highlighted in privacy-focused resources like ethereum.org’s DeFi privacy guide.

Top Coins to Try Swapping First

Not all crypto assets are beginner-friendly. New users are encouraged to start with high-liquidity tokens that are supported across major networks and swap protocols. These pairs offer smoother execution, more predictable pricing, and lower risks of failed transactions.

- BTC ↔ ETH – The most common and liquid pair in crypto.

- ETH ↔ USDT/USDC – Stablecoins ideal for testing swap mechanics.

- ETH ↔ XMR – Privacy-focused pair, see the full Monero swap guide.

- BTC ↔ KASPA – Emerging token, beginner-friendly via Kaspa swap guide.

Best Practices for New Swappers

Many beginner mistakes stem from haste or inexperience. Practicing caution and following verified guides can help you build confidence as you engage in more complex swaps.

- Use supported wallets (e.g., MetaMask, Rabby, XDEFI).

- Verify contract addresses via CoinMarketCap or official token sites—never trust random links.

- Start small – Always test a new platform with a low-value swap.

- Avoid peak congestion times – Track fees using etherscan.io/gastracker.

- Bookmark trusted aggregator tools like CoinoSwap for consistent privacy and rate transparency.

Conclusion

A beginner crypto swap is no longer a complex or risky endeavor—thanks to platforms like CoinoSwap.com, even first-time users can confidently exchange assets with minimal friction. By emphasizing non-custodial access, transparent routing, and wallet-level privacy, CoinoSwap empowers beginners to participate in decentralized finance from day one.