IOST burst onto the scene in 2018 promising 8,000+ TPS and near-zero-fee smart-contract execution thanks to its novel Proof-of-Believability (PoB) consensus. Yet after an early boom, the token slid below one cent and has stayed there for years.

Is a comeback realistic in the next crypto cycle—or is IOST destined to remain a niche, Asia-focused staking network? This Final Boss deep-dive tackles that question head-on.

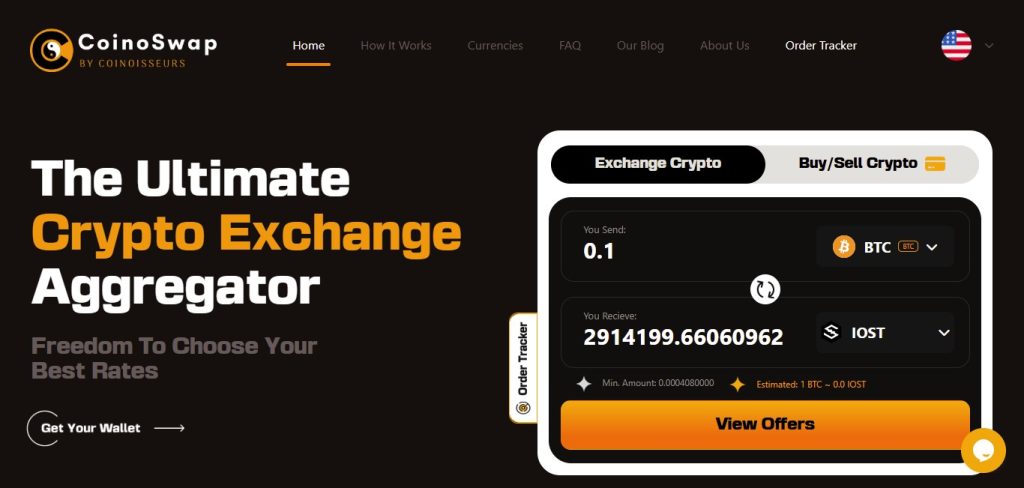

🔎 Inside you’ll find market data, fundamentals, roadmap, expert sentiment, price models for 2025-2030, a moonshot thesis—and an instant, no-KYC swap guide via CoinoSwap.

Metric | Value | |

|---|---|---|

Price | $0.00407 | |

24-Hour Volume | $33.5 M | |

Market Cap | $109.0 M | |

CMC Rank | #358 | |

Circulating Supply | 26.79 B IOST | |

Total / Max Supply | 90 B IOST | |

All-Time High | $0.129 (Jan 2018) | |

Source – CoinMarketCap

IOST (Internet-of-Services Token) is a Layer-1 blockchain purpose-built for ultra-high throughput.

Its PoB consensus blends delegated reputation scores with randomness, producing:

The chain is especially popular among enterprise pilots and education projects in China, Japan, and Korea.

Year | Highlights | Price Range |

|---|---|---|

2018 | Mainnet launch + ICO mania | Peaked at $0.129 |

2021 | Bull-run spike on DeFi hype | Briefly hit $0.09 |

2022 | Crypto winter—rangebound | $0.010 → $0.005 |

2023–24 | Flat; staking steady | $0.0035 → $0.0065 |

2025 YTD | Slight uptick on bridge news | $0.0038 → $0.0046 |

Pillar | Details |

|---|---|

Consensus | PoB—validators with strong historical reliability earn higher “believability” scores → faster block production |

Scalability | Laboratory tests at 8 k TPS; mainnet routinely handles 1 k + TPS without congestion |

Staking | Native staking via IWallet, TokenPocket, IOSTABC; no lock-ups; slashing for malicious nodes |

Developer Tools | JavaScript smart-contract engine, SDKs for JS, Go, Python, Rust |

Partnerships | Chinese gov’t education pilots; MOBI alliance (mobility); multiple GameFi studios |

Sector | Example dApps | Status |

|---|---|---|

Gaming / NFTs | XPET, IOSTPlay | Small but active |

Education | “ChainUp Edu” pilot—blockchain certificates | Live |

Enterprise Data | Logistics tracking PoCs in Shanghai | In testing |

Basic DeFi | iSwap, IOSTDEX | Low TVL |

IOST’s ecosystem is modest versus trendier chains, yet provides steady, fee-light staking revenue.

Year | Milestone |

|---|---|

2025 | SDK revamp, English documentation overhaul, APAC dev hackathons |

2026 | EVM-compatibility bridge + cross-chain liquidity modules |

2027 | PoB 2.0 upgrade—lighter validator bootstrapping, faster sync |

2028 | Community vote on token-burn + inflation-control policy |

2029 | Tier-1 CEX listings push, perpetuals on dYdX / GMX |

2030 | Regional DAO expansion; ZKP module for enterprise privacy |

Dev Attrition – Many builders migrated to Solana / Polygon due to funding incentives.

Chain | TPS | Consensus | TVL (DeFi) | Hype Score* | Verdict |

IOST | 8 k | PoB | ~$8 M | ★★☆ | Tech strong, hype weak |

2 k | Sharded PoW/PoS | ~$35 M | ★★★ | Gaming pivot | |

Aptos | 160 k (lab) | AptosBFT | ~$190 M | ★★★★ | Heavy VC push |

Kaspa | 100+ blocks/s | GHOSTDAG PoW | N/A | ★★★ | Ultra-fast PoW |

*Subjective scale based on social volume and Google Trends.

Year | Conservative | Base | Bullish | |

|---|---|---|---|---|

2025 | $0.0038 | $0.0062 | $0.010 | |

2026 | $0.0050 | $0.0084 | $0.015 | |

2027 | $0.0072 | $0.011 | $0.020 | |

2028 | $0.0065 | $0.014 | $0.030 | |

2029 | $0.0085 | $0.017 | $0.045 | |

2030 | $0.010 | $0.022 | $0.15+ | |

Valuation Math: At a $7.5 B market cap and ±25 B effective supply, token = $0.30 (≈ 25 × from today).

CoinoSwap lets you move from research → execution in 60 seconds.

Related: Kaspa Swap Guide — No KYC

IOST isn’t dead—it’s dormant.

If the team nails its EVM bridge, executes a meaningful token burn, and grabs Tier-1 listings, the chain could re-rate sharply.

For speculators, it’s a low-cost ticket on a high-throughput Layer-1 comeback.

For stakers, it’s a steady APY play with minimal fees.

Ready to act? Swap into IOST instantly on CoinoSwap today.

Will IOST reach $1?

That would require a 250× move from today’s price. It likely needs a major token-burn (≥ 90 % supply cut), a breakout dApp, and Tier-1 listings before 2030.

Can IOST hit $0.25–$0.30?

Yes, in the bull-case Moonshot where a 20–30 B token burn passes, the EVM bridge pulls > $500 M TVL, and daily volume tops $1 B.

Is IOST inflationary?

Yes. Block rewards remain, but a 2028 community vote is set to consider emission cuts and token burns.

How many IOST coins are there?

≈ 26.8 B in circulation; max supply is capped at 90 B unless a burn proposal passes.

Does IOST support staking?

Absolutely. Stake via IWallet, TokenPocket, or IOSTABC and earn ~9–12 % APY; slashing applies for malicious nodes.

Where can I swap IOST instantly?

On CoinoSwap—our instant crypto exchange aggregator compares 8 + partners so you get the best rate with no KYC.

Is IOST better than Aptos or Zilliqa?

Depends on priorities: IOST delivers high TPS and fair token distribution; Aptos offers heavy VC funding and Move language; Zilliqa pushes EVM gaming.

Is IOST ISO 20022 friendly?

Not natively, but future SDK upgrades aim to make PoB nodes compatible with ISO-20022 messaging for enterprise pilots.

What drives IOST price?

Key catalysts: staking yields, token-burn policy, cross-chain liquidity via the 2026 EVM bridge, and new CEX listings.

What’s the Moonshot scenario?

Under aggressive adoption—token burn, TVL > $1 B, and Tier-1 listings—IOST could reach $0.25–$0.30 by 2030.