Crypto markets move in cycles, but very few projects stay laser-focused on real-world adoption the way Electroneum (ETN) does. From its 4-million-plus mobile-wallet users to its vendor-ready AnyTask platform, ETN keeps chasing the unbanked narrative that first put it on the map in 2017. Yet the token still trades for a fraction of a cent. Can the next leg of the market finally price in Electroneum’s grassroots reach and corporate remittance pilots?

In this deep-dive we’ll cover everything you need to know — from tokenomics and roadmap milestones to TA levels and moon-shot scenarios — and finish with a no-login swap tutorial so you can act the moment conviction strikes.

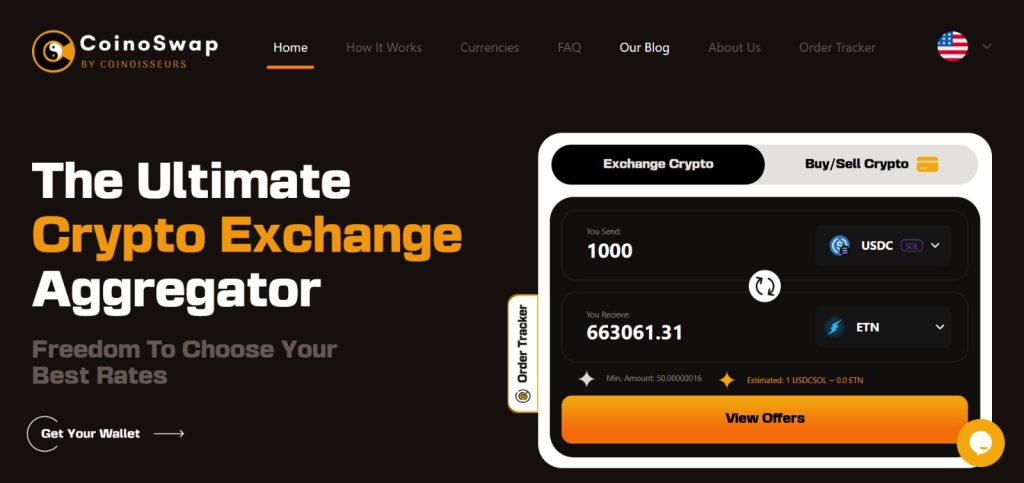

Need ETN fast? Swap instantly on CoinoSwap, the instant crypto exchange aggregator that compares live quotes from 9 + partners — just paste your receiving address, no account or KYC required.

Electroneum launched in 2017 with a bold idea: use a mobile-first, low-fee blockchain to bring digital payments to emerging markets. Key pillars:

Feature | Why It Matters |

|---|---|

App-Based Ecosystem | Android/iOS wallet, in-app swaps, airtime & utilities top-ups |

Vendor Tools | AnyTask freelance marketplace & plug-and-play API for merchants |

Moderated Proof-of-Responsibility | Hybrid PoW/validator model slashes energy use while keeping decentralization |

Regulatory Focus | FCA registration in the UK strengthens compliance credibility |

While critics call ETN “sleepy,” the team keeps shipping: NFT marketplace integrations, enhanced KYC tiers, and NGO partnerships that pay field workers in ETN.

If you’re new to micro-caps that marry real-world use with compliance, you might also like our deep dive into Kaspa’s GhostDAG roadmap, another project proving that fundamentals still matter in low-cap territory.

Year | Price Range | Narrative Highlights |

|---|---|---|

2018 | ATH $0.1821 → $0.02 | Post-ICO hype, exchange listings (CoinLore) |

2020 | $0.003 → $0.007 | “AnyTask” beta launches, remittance pilots start |

2021 | $0.007 → $0.013 | Mobile cloud-mining sunset; pivot to sustainability |

2024 | $0.0015 → $0.003 | Bear-market bleed; daily users steady |

2025 (YTD) | $0.00137 (ATL) → $0.00209 | Quiet accumulation, liquidity on DEX aggregators (CoinGecko) |

Metric | Value |

|---|---|

Price | $0.00152 |

Market Cap | $27.0 M |

Market Rank | #739 |

Circulating Supply | 17.98 B ETN (Max 21 B) |

24-h Volume | $0.68 M |

All-Time High | $0.1821 (Jan 2018) |

All-Time Low | $0.00137 (Jul 2025) |

Source: CoinMarketCap and CoinGecko

Catalyst | Impact |

|---|---|

Real-World Utility – airtime top-ups in 140+ countries | Direct use case rare among low-cap coins |

Corporate Remittance Pilots | Trials in Latin America & Africa could scale volumes |

FCA Registration | Regulatory moat vs unregistered micro-cap competitors |

AnyTask 3.0 | Bringing new buyer UX and escrow to the gig economy |

Risks: Thin exchange support, low liquidity, and competition from stablecoin remittance rails.

If you care about tokens that actually move value across chains, check our cross-chain swap guide to see how ETN compares to other assets when bridging wallets.

Risks: Thin exchange support, low liquidity, and competition from stable-coin remittance rails.

For a broader view of how regulatory narratives drive micro-cap pumps, our Turbo (TURBO) forecast breaks down a similar compliance-versus-hype tension.

Milestone | ETA | Importance |

|---|---|---|

AnyTask 3.0 mainnet | Q3 | Could reignite demand via revenue share burns |

Layer-2 Instant Payments | Q4 | Sub-second confirmations for retail |

Additional FCA Permissions | Q4 | Opens UK e-money integrations |

New Africa Remittance Corridor | Q4 | Adds real fiat on-ramps |

Metric | ETN | XNO (Nano) | XEC (eCash) |

|---|---|---|---|

App installs | 4 M+ | ~200 k | n/a |

Regulatory licence | Yes (UK) | No | No |

Block time | 2 min | 0.4 s | 0.25 s |

Max supply | 21 B | 133 M | 21 T |

Nano & eCash boast faster L1 speed, but lack ETN’s compliance stack and consumer app.

If you’re shopping privacy-leaning assets instead, also check our price prediction forecasts from the likes of XMR and FIRO on swap speed and anonymity.

“Few projects have real user numbers; Electroneum’s 4 million wallets remain one of the industry’s sleeper metrics.” — Web3Edge Weekly (June 2025)

“Regulated micro-caps often pop when big exchanges seek compliant low-caps to list.” — Quant Desk Note, Tier-1 CEX (May 2025)

“If AnyTask revenue starts burning ETN, supply shock could turn pennies into dimes quickly.” — CryptoPayments Research (April 2025)

A decisive weekly close above $0.0022 could open a run to $0.0040, doubling current price.

Year | Conservative | Moderate | Bullish |

|---|---|---|---|

2025 | $0.0020 | $0.0035 | $0.0060 |

2027 | $0.0040 | $0.0075 | $0.0150 |

2030 | $0.0080 | $0.0200 | $0.0500 |

Assumptions: AnyTask revenue share, two tier-1 listings, and global remittance corridor live by 2027. Figures adjust for max supply.

If Electroneum secures a Western Union-style remittance partnership plus auto-buyback from AnyTask fees and lands on Coinbase or Binance, speculative flows could push a $1 B market cap — translating to ≈ $0.10 per ETN. That’s a 65 × from today, extreme but not impossible in a euphoric alt-season.

That’s it — swap directly to and from your own wallet, no login or account needed.

Electroneum may look dormant on the charts, but beneath the surface lies a regulation-minded payments network with genuine users — a rarity among sub-$30 M caps. By marrying a compliant framework with grassroots utility, ETN positions itself as a dark-horse remittance token in the next adoption wave.

If the team executes on Layer-2 speed upgrades and converts AnyTask cash flow into token burns, ETN’s next cyclical rally could surprise the skeptics. Whether you’re speculating on a $0.01 breakout or stacking for a long-shot $0.10 moonshot, CoinoSwap lets you move in or out of ETN in seconds — no KYC hassles, ever.

What happened to Electroneum?

After the 2018 ICO boom ETN refocused on real-world payments. The team sunset mobile cloud-mining (2021), secured FCA registration, and rolled out the AnyTask freelance marketplace. Development never stopped—price just lagged the hype cycle.

Is Electroneum dead?

No. The chain is live, the mobile app has 4 M+ installs, and new roadmap items (AnyTask 3.0, Layer-2 payments) are scheduled for 2025.

Will Electroneum reach $0.01 again?

Our bullish 2030 target is $0.05, so a $0.01 retest is feasible if AnyTask burn mechanics + new exchange listings deliver real demand.

Will Electroneum reach $1?

That would require a ~$21 B market cap—unlikely without global remittance dominance.

Could Electroneum ever hit $10?

A $10 ETN implies > $200 B cap—larger than today’s Binance Coin. Practically impossible under current tokenomics.

Is Electroneum a good investment?

High-risk/high-reward micro-cap. Real utility and FCA licensing are positives; thin liquidity and exchange depth are negatives.

How many Electroneum coins are there?

~17.98 B ETN are in circulation out of a 21 B maximum supply.

ETN price prediction tomorrow

Short-term moves depend on Bitcoin sentiment; statistical models peg ±5 % daily volatility.

ETN price prediction 2030

See our long-range table: conservative $0.008, moderate $0.02, bullish $0.05.

Where can I buy ETN quickly?

Use CoinoSwap to compare instant-swap quotes and receive ETN directly in your wallet—no login, no KYC under €700.

Does Electroneum still support mobile cloud mining?

No. Cloud mining was retired in 2021 to comply with Google/Apple policies.

How do I mine Electroneum now?

You can GPU-mine on the hybrid PoR chain, but profitability is low; most users simply buy ETN via swaps.