After spending two full market cycles in the shadows while DeFi, NFTs, and AI coins stole the limelight, prediction-market tokens are back on traders’ radars. Augur (REP) — the original, fully-decentralized oracle and wagering protocol — is staring down a triple-stack catalyst window:

Layer-2 deployments on Optimism and Arbitrum, rumors of a multi-CEX relisting push, and a new REP-for-fee rebates model have reignited the discussion:

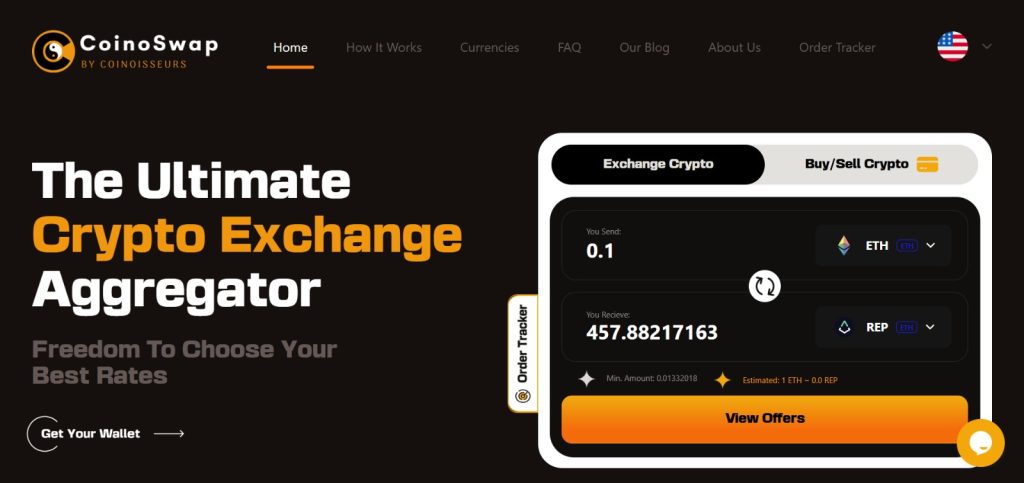

Below is a Final-Boss deep dive, built on CoinoSwap’s proven PP template, blending fundamentals, on-chain data, and expert sentiment — plus a no-KYC swap guide so you can act fast via CoinoSwap, the instant crypto exchange aggregator.

Augur is an open-source prediction-market protocol on Ethereum where anyone can create and trade markets on real-world events. Its 2020 v2 upgrade introduced DAI-denominated markets, faster resolution, and fee-sharing. REP:

Related read: What Is a Cross-Chain Swap — A Beginner’s Guide

Year | Average Price | Catalyst |

|---|---|---|

2017-18 | $5 → $123.24 ATH | ICO mania & oracle hype |

2018–19 | $10–$15 | Post-ICO bear market |

2020 | $15 → $23 | Augur v2 launch |

2021–23 | $3 → $1 | Liquidity drain to DeFi; market apathy |

2024–25 YTD | $0.50 → $0.80 | Layer-2 rollouts & relisting rumors |

Metric | Value |

|---|---|

Current Price | $0.8082 USD |

Market Cap | ≈ $8.89 million |

Market Rank | #1165 |

Circulating / Max Supply | 11 M REP / 11 M REP |

30-Day High / Low | $0.83 / $0.617 |

All-Time High (Jan 2018) | $123.24 |

Data source: CoinMarketCap

Scarcity note: with the full supply already circulating, any uptick in demand can move price disproportionately.

Catalyst | Why It Matters |

|---|---|

Election & Sports Cycles | Historically spike user counts & fee burn. |

Layer-2 Fee Compression | < $0.05 settlement → retail-friendly. |

CEX Relistings | Higher order-book depth + media buzz. |

“Oracle Wars” Narrative | REP offers a decentralized alternative to Chainlink’s model. |

See also: Kaspa (KAS) Price Prediction 2025 – 2030 — another fixed-supply play we covered.

Risk | Impact | Mitigation |

|---|---|---|

Thin Liquidity | Wider spreads, slippage | Layer-2 liquidity mining |

Regulatory Gray Area | Market takedowns | Front-end decentralization |

Competing Protocols (Polymarket, Gnosis) | User siphon | REP staking yield upgrade |

Mobile-First v3 UI – mainstream onboarding.

Metric | Augur (REP) | Gnosis (GNO) | Polymarket (USDC) |

|---|---|---|---|

Oracle Model | REP-bond disputes | SafeSnap + PoS | UMA / manual |

Max Supply | 11 M (fixed) | 3 M | n/a |

Layer-2 Support | Optimism, Arbitrum | Gnosis Chain | Polygon |

Governance | Token voting | Delegated PoS | Centralized |

“At sub-$1, REP feels like early-Chainlink beta. If the oracle narrative returns, upside could be violent.” — NeoMarkets Research

“Augur v2 finally solved liquidity fragmentation; watch for CEX relistings as the spark.” — DeFi Deep-Dive Newsletter

Weekly VWAP pivot: $0.80 — close above flips trend bullish.

Year | Conservative | Moderate | Bullish |

|---|---|---|---|

2025 | $0.90 | $1.50 | $2.50 |

2027 | $1.50 | $3.00 | $5.00 |

2030 | $3.00 | $6.50 | $10.00 |

Methodology: discounted cash-flow of fee revenue, CEX depth curve, address-growth projections, and historical mean reversion versus ETH.

Imagine the following domino-esque chain reaction:

With a reduced float and fresh CEX order-books, REP could revisit $10 – $12 by late-2027, handing early accumulators a 10–15× return. Speculative? Absolutely — but that’s what moonshots are made of.

Want even more privacy? Check our guide on Buying Crypto Without KYC in 2025.

With a fixed supply, renewed community energy, and a perfect election-sporting catalyst combo, Augur may be the dark-horse oracle play of the next cycle. Execute on the roadmap, land those CEX listings, and a move to $3–$5 by 2030 looks realistic.

Ready to move? Swap directly to and from your own wallet — simply paste your receiving address, no login or account needed. Grab REP in seconds on CoinoSwap and ride the prediction-market renaissance.