As blockchain infrastructure shifts toward Web3 and decentralized computing, Ankr (ANKR) has emerged as a versatile node-hosting and staking platform. By abstracting away the complexity of running nodes and offering liquid staking solutions, Ankr aims to become the “AWS of Web3.” With on-chain activity and adoption growing, many are asking: Can ANKR reach $1 by 2030? And what milestones lie ahead in the 2025–2030 cycle?

In this deep-dive price prediction, we’ll cover Ankr’s technology, historical trajectory, market snapshot, technical & fundamental outlook, expert sentiment, competitive positioning, moonshot scenario, extended forecasts, and FAQ. Whether you’re looking to swap ANKR instantly or planning a strategic allocation, this guide will give you the clarity to act.

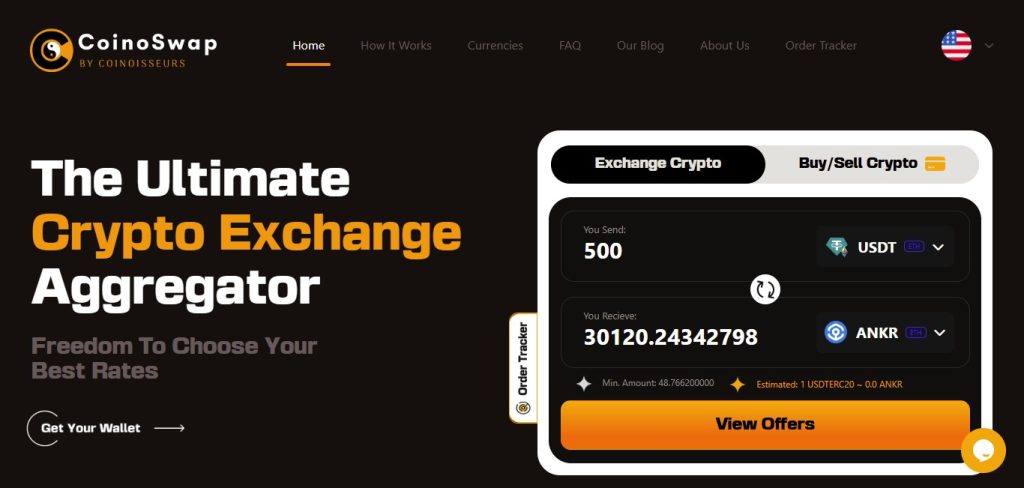

✅ Trade ANKR on CoinoSwap — the instant crypto exchange aggregator that compares live rates from 9+ partners with no signup or KYC required, and let you swap directly to and from your own wallet — simply paste your receiving address, no login or account needed.

Ankr is a decentralized infrastructure platform offering node hosting, liquid staking, and RPC services across 40+ chains. By pooling user capital and abstracting technical complexity, Ankr allows any developer or staker to participate in securing networks without running their own hardware.

📘 Related: For another deep-dive into Web3 infrastructure tokens, see our Kaspa (KAS) Price Prediction 2025–2030.

Metric | Value |

|---|---|

Current Price | $0.01648 |

Market Cap | $164.85 M |

Market Rank | #258 |

Circulating Supply | 10 B ANKR |

Max Supply | 10 B ANKR |

24-Hour Volume | $18.96 M |

All-Time High | $0.2252 (Mar 28, 2021) |

Source: CoinMarketCap

🧪 Fundamental Analysis: What Drives ANKR’s Value?Infrastructure Demand: dApps require fast, reliable RPC; Ankr’s multi-chain nodes capture growing Web3 traffic.

Feature | Ankr | Infura | QuickNode |

|---|---|---|---|

Multi-chain Support | 40+ networks | Ethereum only | 20+ networks |

Liquid Staking | Yes | No | Emerging |

Decentralization | Node marketplace model | Centralized API farm | Hybrid |

Pricing | Pay-per-call / tiered | Free tier + paid plan | Flexible tiers |

“Ankr’s liquid staking model brings yield efficiency to everyday users.”

— DeFiRate Analytics (June 2025)

“Reliable RPC is the backbone of scalable dApps. Ankr is leading the open-source charge.”

— Web3 Infrastructure Review (May 2025)

Under a hyper-bullish hypothesis where:

Year | Conservative | Moderate | Bullish |

|---|---|---|---|

2025 | $0.12 | $0.16 | $0.24 |

2026 | $0.16 | $0.23 | $0.37 |

2027 | $0.20 | $0.30 | $0.50 |

2028 | $0.25 | $0.40 | $0.75 |

2029 | $0.30 | $0.50 | $1.00 |

2030 | $0.35 | $0.60 | $1.00–$1.50 |

Forecasts factor in protocol milestones, growing staking TVL, and broader market cycles.

🔗 For more swapping tips, see our Crypto Swap Guide.

Ankr sits at the intersection of Web3 infrastructure and liquid staking innovation. By simplifying node operations and offering yield-bearing tokens, ANKR bridges institutional reliability and retail accessibility. If Ankr executes its roadmap—especially cross-chain bridges and zkRPC—the path to $1+ by 2030 is plausible. As dApps proliferate and staking demand intensifies, ANKR’s utility could underpin sustained token appreciation.

👉 Swap USDT to ANKR instantly on CoinoSwap — let you swap directly to and from your own wallet, no KYC needed.

Is there a future for ANKR?

Yes—Ankr’s node-hosting and liquid staking meet core Web3 needs, anchoring its long-term relevance.

Will ANKR hit $1?

A $1 price implies a $10 B+ market cap. Under a bull-run with major DeFi growth and TVL expansion, it’s possible by 2030.

Does ANKR have a max supply?

Yes—10 billion ANKR, fully issued and circulating.

What does ANKR crypto do?

ANKR powers payments to node operators, staking rewards distribution, and protocol governance.

Who uses ANKR?

dApp developers, DeFi yield seekers, enterprises, and analytics providers rely on Ankr’s network.

Is ANKR staking safe?

Contracts are audited, but staking carries smart-contract and protocol risk. Always consider slashing parameters.

How do I stake ANKR?

Stake via Ankr’s portal or partner platforms to receive liquid staking tokens (e.g., aETHc) while earning rewards.

Where can I store ANKR safely?

Supported wallets include MetaMask, Trust Wallet, and Ledger hardware wallets for multi-chain ANKR.

How many ANKR tokens are staked?

As of July 2025, over 3 billion ANKR are locked in liquid staking contracts.

What fees does Ankr charge?

Node-hosting and staking fees vary by chain; typical RPC calls incur nominal per-call charges—see Ankr’s docs for details.

Who founded Ankr?

Ankr was founded by Chandler Song and Ryan Fang; governance now resides with the ANKR DAO community.