As the crypto market matures, few Layer-1 blockchains from the 2018 era have managed to stay relevant. Zilliqa (ZIL) is one of the few exceptions.

Launched with a bold vision to solve scalability via sharding, Zilliqa was the first public chain to implement this innovation on main-net. Fast forward to 2025, and Zilliqa is back in the spotlight — now armed with full EVM compatibility, an upcoming Zilliqa 2.0 throughput upgrade, and a growing footprint in the Web3 gaming and DeFi spaces.

But the question remains:

Can ZIL reclaim its all-time highs—or even surpass them—by 2030?

In this deep-dive, we explore what’s powering Zilliqa’s next potential breakout, unpack the tokenomics, on-chain trends, technical levels, and roadmap milestones. Whether you’re looking to swap ZIL instantly without KYC, compare Layer-1 projects, or plan a long-term allocation, this guide equips you with the facts.

🔍 We’ll also share expert opinions, model realistic price targets from 2025 through 2030, and give you a step-by-step tutorial on how to access the best Zilliqa swap rates with no account signup — right from your own wallet.

A credible Zilliqa price prediction rests on three levers:

Base-case maths put the ZIL price target near $0.02 by 2025 and $0.09 – $0.15 by 2030. Ready to act?

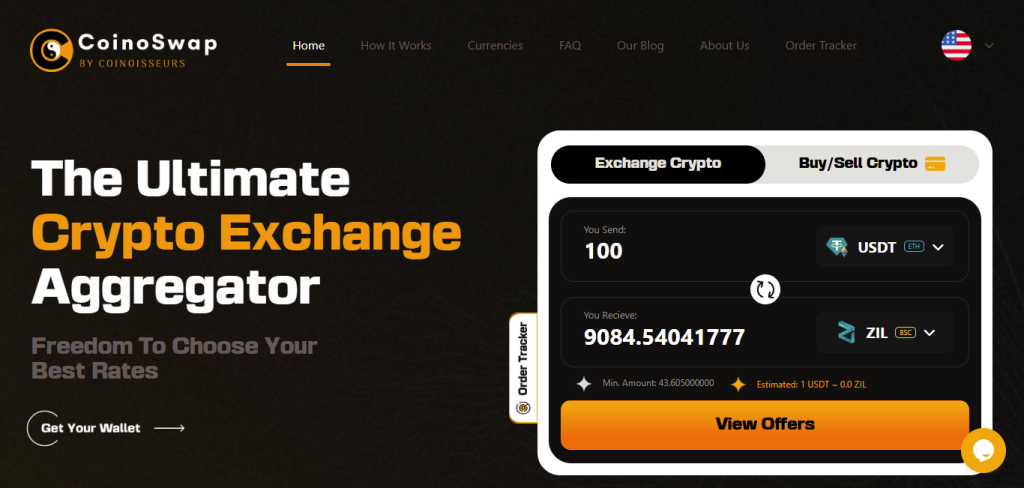

✅ Ready to swap ZIL now? Use CoinoSwap.com — the non-custodial instant crypto exchange aggregator that compares 8+ partner rates with no login or KYC.

Metric | Value | 30-Day Δ | Why It Matters for Any ZIL Price Prediction 2025 |

|---|---|---|---|

Price | $0.01100 | +7.72 % (1d) | Trading slightly above accumulation zone; bullish short-term momentum. |

Market Cap | $214.67 M | +7.72 % | Still undervalued relative to Layer-1 competitors. |

Rank | #177 | ↓ from #154 | Downtrend in broader market affects position despite stable fundamentals. |

Circulating / Max Supply | 19.5 B / 21 B ZIL (≈92.86 %) | Steady | Most coins already released → less inflation risk. |

Total Supply | 20.19 B ZIL | — | Near-complete supply issuance keeps tokenomics lean. |

Staked Supply | ~3.2 B (est. 16.4 %) | +3.3 % | Locking tokens reduces sell pressure — key support factor. |

24 h Volume | $14.92 M | +3.55 % | Healthy liquidity confirms active interest. |

All-Time High | $0.2563 (May 2021) | −95.68 % | Full recovery = 23× from current price; sets upper bound for long-term upside. |

Inflation | 2.4 % p.a. → 0 % in 2032 | — | Lower than SOL (7 %) or AVAX (4 %) = strong long-term fundamentals. |

Zilliqa was the first public blockchain with sharding (2019). Main-net clocks ~2 800 TPS; Zilliqa 2.0 test-nets already push 15 – 20 k TPS—core to every bullish Zilliqa price prediction 2030.

Live since April 2025. Expect:

Variable | Detail | Impact on Zilliqa coin price prediction |

|---|---|---|

Inflation | 2.4 % until 2032, then 0 % | Scarcity narrative gets stronger; good for long-term ZIL price targets. |

Staking APY | 12 % nominal (≈ 9 % real) | Encourages holding over selling. |

Treasury Unissued | < 3 % supply | Minimal unlock risk vs ICO-heavy chains. |

Date | Active Addresses | NVT Ratio | Price | Comment |

|---|---|---|---|---|

Aug 2020 | 15 k | 257 | $0.026 | Main-net hype. |

Dec 2021 | 97 k | 88 | $0.060 | P2E gaming peak. |

Jun 2024 | 33 k | 206 | $0.015 | Bear-market capitulation. |

Jun 2025 | 45 k | 132 | $0.011 | Users ↑ 36 % YoY while price ↓ — bullish divergence. |

Take-away: utilisation is rising faster than valuation—a classic early-reversal tell.

Indicator | Reading | Interpretation |

|---|---|---|

RSI (Weekly) | 38 (rising from 34) | Momentum is recovering, early signs of bullish reversal. |

MACD | Bearish crossover fading | Histogram shrinking, bulls may take control in 1–2 weeks. |

200-Week EMA | ~$0.018 | Still a key breakout resistance — watch for volume spikes. |

Fib 0.236 (ATH → cycle low) | ~$0.045 | Remains the “price discovery” target if $0.018 breaks. |

Weekly Trend | Sideways to Slightly Bullish | 5 green weekly closes out of last 8. Support at $0.009. |

Quarter | Milestone | Price Impact |

|---|---|---|

Q3 2025 | Main-net EVM launch | TVL & dev-count inflection. |

Q4 2025 | Zilliqa 2.0 (20 k TPS) | “Fastest L1” narrative ignition. |

H1 2026 | Liquid-Staked ZIL (lsZIL) | Yield hunters arrive → liquidity premium. |

2027 | Gaming SDK v2 + Unreal plug-ins | Expands real-time game portfolio. |

Year | Bear 🐻 | Base 🐂 | Bull 🚀 |

|---|---|---|---|

2025 | $0.012 | $0.020 | $0.035 |

2026 | $0.017 | $0.028 | $0.050 |

2027 | $0.024 | $0.038 | $0.070 |

2028 | $0.030 | $0.055 | $0.090 |

2029 | $0.040 | $0.068 | $0.120 |

2030 | $0.055 | $0.095 | $0.150 |

(Blend of Metcalfe’s Law & adjusted NVT.)

Metric | ZIL | NEAR | MultiversX |

|---|---|---|---|

Live TPS | 2 800 | 3 k | 15 k (lab) |

Inflation | 2.4 % | 4.5 % | 8 % |

Staking APY | 12 % | 10 % | 7 % |

DeFi TVL | $58 M | $250 M | $120 M |

DAU (wallets) | 45 k | 90 k | 38 k |

CoinoSwap lets you swap directly to and from your own wallet — simply paste your receiving address, no login or account needed.

Pick your coin → Choose your exchange → Paste your wallet → and that’s it.

Need more detail? See our Cross-Chain Swap Guide on the blog.

Every Zilliqa price prediction lives or dies on adoption. EVM support, Zilliqa 2.0 throughput and gaming traction give ZIL three clear shots on goal. Accumulating below $0.015 via an instant ZIL swap keeps downside capped while offering a realistic path to 5 – 12 × upside into 2030. DYOR, size positions wisely

If you believe in scaling solutions that preserve decentralization, offer strong staking rewards, and can host fast, final, frictionless swaps, then Zilliqa deserves your radar.

Zilliqa has gone through multiple market cycles—hyped at launch, overlooked in the Layer-1 rush, and now quietly rebuilding with a powerful new stack.

From on-chain gaming and creator tokenization to low-inflation staking and EVM deployment, Zilliqa is no longer “just the first sharded chain”—it’s becoming a high-performance, multi-vertical L1 with real fundamentals.

Whether you’re planning to hold ZIL long term, farm liquid staking yields, or just want to buy Zilliqa anonymously, the instant ZIL swap option on CoinoSwap puts full control back in your hands—no KYC, no delays, no wallet risk.

If the 2025–2026 bull market accelerates, we could see ZIL reprice toward its prior ATH (~$0.25). But even without that, a realistic 5–12× from current levels is enough to justify a well-sized, well-researched allocation.

✅ Visit CoinoSwap.com today to find the best ZIL swap rates in real time

Explore other CoinoSwap forecasts for trending Layer-1 and utility tokens:

• Aptos (APT) Price Prediction 2025–2030

• Tezos (XTZ) Price Prediction 2025–2030

• VeThor Token (VTHO) Price Prediction 2025–2030

What is Zilliqa (ZIL)?

Zilliqa is a high-throughput Layer-1 blockchain that introduced sharding as a live scalability solution. It now supports EVM contracts, making it compatible with Ethereum-based tools while maintaining its original Scilla smart contract language. Its 2.0 upgrade targets >20,000 TPS.

Will Zilliqa reach $1 by 2030?

A $1 ZIL would imply a ~$20 billion market cap. While aggressive, it’s not impossible in a multi-trillion crypto cycle combined with major DeFi or gaming traction. More realistic targets are Base case $0.09 – $0.10; bull case $0.15 + if TVL tops $700 M, based on user growth, staking yield, and token supply dynamics.

Is ZIL a good investment in 2025?

ZIL presents a high-risk, high-reward opportunity. If the EVM upgrade and Zilliqa 2.0 roadmap are executed well, ZIL could outperform in a Layer-1 revival narrative. However, competition is intense and investor conviction hinges on ecosystem growth.

How do I buy ZIL anonymously?

You can swap Zilliqa without KYC using CoinoSwap’s aggregator platform. Just paste your wallet address and choose from trusted partner exchanges like StealthEX, LetsExchange, or ChangeNOW.

What’s the inflation rate of ZIL?

ZIL has a low, predictable emission schedule: 2.4% annual inflation until 2032, after which it becomes a fixed-supply token. This makes Zilliqa more deflationary than Solana, Avalanche, or Cardano.

Is Zilliqa a good investment?

High-beta alt; reward outweighs risk if throughput upgrades deliver.

Is Zilliqa better than Ethereum or NEAR?

Each chain has trade-offs. Zilliqa wins on TPS and staking yield, but trails Ethereum in DeFi depth and NEAR in user onboarding. However, Zilliqa’s non-custodial design, high staking APY, and optional anonymity for users make it ideal for privacy-first crypto swaps.

CoinoSwap is a leading instant crypto exchange aggregator that allows you to swap and buy cryptocurrencies instantly with the best crypto exchange rates. Offering a seamless and user-friendly experience, CoinoSwap ensures you get the most competitive rates for best crypto to crypto exchange transactions, all without the need for registration.